Development is hard, very hard. Just ask our clients. So is predicting what your project is worth after it is completed and what the returns will look like. Here is our take on how to best navigate modeling an exit, which has evolved from numerous conversations with our clients and equity partners.

–

Capitalization rates are one of the most important valuation metrics in real estate finance and investment as they provide a uniform and objective measure of the expected annual return of an asset relative to its price.

Reports of property sales and their cap rates appear in both formal and informal settings. Statements such as “that 100-unit apartment building traded at a 5.5% cap”, can be an indicator of the relative attractiveness of submarkets, asset classes, and a broad signal of supply and demand in/balance. Furthermore, as assets trade, speculators use this information for their own cap rate-based valuations. It is an essential tool in evaluating investment opportunities as it’s a distilled indication of pricing.

Being so frequently tossed about as cap rates are, they must be measured uniformly, right?

They are not.

Whose Rate?

The question that seems to be in perpetual debate is: “Whose cap rate is quoted, the buyer’s, or the sellers?” Or, whose net operating income is used to extrapolate the cap rate?

That matters in states like CA where properties are only reassessed when they trade. Since annual NOI/Price = cap rate and NOI is a post-tax number, the purchase/sale of an asset can create a meaningful variance between the in-place and go-forward NOI. The sellers operating expenses reflect the historical tax bill and a potential buyer will have a different tax basis based on the purchase price.

The implications of this debate are especially material on projects that experience dramatic appreciation/value creation between sales (e.g. development) and for real estate speculators in general.

For example:

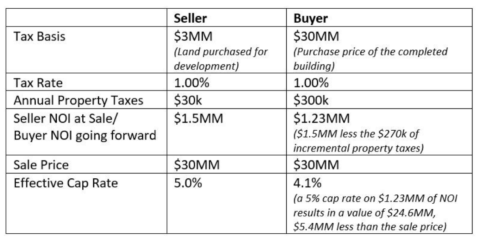

Say a developer purchases a vacant lot for $3.0MM in an area where property taxes are 1.0%. Over the next 12 months, that developer builds and leases a building that is now cash-flowing with NOI of $1.5MM and markets the asset for sale at $30MM (assuming a 5.0% exit cap).

The developer’s annual property taxes of $30k for the land (1.0% of $3.0MM) are substantially lower than the prospective buyers go-forward property taxes of $300,000 (1.0% of the $30MM purchase price) by a factor of ten! Keeping other revenue and expenses constant, the $270,000 increase in tax expense reduces a buyer’s go-forward NOI to $1.23MM. At a 5.0% cap, the building value is only $24.6MM, $5.4MM less than the asking price. At a $30MM ask, go-forward NOI of $1.23MM creates an effective cap rate of 4.1% for the buyer ($1.23MM / $30MM).

The seller may think a 5.0% cap rate is a conservative assumption at sale, whereas a buyer may look at their projected $1.23MM NOI at a 5.0% cap, conclude that the asset is overpriced and view the effective cap rate of 4.1% on the asking price as too aggressive.

As a result, the seller’s vs. buyer’s perspective becomes a material consideration when evaluating the economics of a deal and modeling an exit cap. This also matters when referencing the comparable sales in the market where price and cap rates are reported, but where NOI may be unknown. How do we know from what perspective caps rate are reported from? And which cap rate should developers use when modeling the potential windfall from selling a completed project? (e.g. from above; is 4.1% or 5.0% correct?)

Findings

We turned to the market research experts at the CoStar group, other brokers at JLL, and sources of capital we know well to answer whether the buyers or sellers cap rates are reported to the marketplace. This would imply that either the buyers go-forward tax expense and NOI are used to determine a cap rate or if the sellers in-place NOI with their original tax basis is typical.

To our surprise, there was no clear answer.

CoStar came across this problem a few years ago recognizing that there was no reporting standard and has since been intentionally asking for reported cap rates that use the in-place NOI at time of sale divided by the contracted sale price, meaning that the seller’s cap rate trumps. In practice, however, we find ourselves repeatedly having this conversation while raising development equity about assuming an exit cap from the buyer’s perspective since a prospective buyer will consider a step up in tax basis when making an offer.

Some others suggested including additional tax expenses after stabilization derived from a tax basis approximately equal to the cost of construction. That way, the step up in basis is not as dramatic (the difference in costs and sale price vs. land basis and sale price) and potential buyers can get a better idea of what stabilized operations look like under new ownership.

One more arithmetic solution for determining a “fair” purchase price with a single cap rate is to isolate the operations of the asset from any change in tax by using pre-tax operating income (much like EBITDA multipliers). Adding back the seller’s annual tax expense to NOI and then dividing that income by the cap rate plus the tax rate creates a consistent price form either perspective. (NOI + Current Annual Tax Burden) / (Cap Rate Assumption + Tax Rate) Or (NOI + (Sellers Basis * Tax Rate)) / (Cap Rate Assumption + Tax Rate)

Referencing the example above ($1.5MM NOI, seller’s basis of $3MM, taxes of 1.0%, and a 5.0% cap), Seller NOI of $1.5MM adding back $30k for the seller’s current tax expense is $1.53MM pre-tax. $1.53MM divided by the 5% cap rate plus the 1% tax rate results in a proposed $25.5MM price. Buyer NOI of $1.23MM adding back $300k for the buyer’s future tax expense is also $1.53MM pre-tax. $1.53MM divided by the 5% cap rate plus the 1% tax rate also results in a $25.5MM price for the asset.

Going Forward

We found that the most rational method for our clients is to tailor the assumptions depending on if you are modeling the whole proforma from the seller’s perspective (present) vs. the buyer’s perspective (future).

With a present view, assume today’s market rents, operating expenses, property tax basis and do not trend any numbers to determine NOI at sale. With a future view, use trended rents, trended operating expenses, and a potential buyer’s elevated tax basis. The future view could prove to be less reliable as it introduces additional assumptions such as income and expense growth rates and the margins at which a potential buyer could operate the asset vs. what the developer knows is achievable. Nevertheless, this boils down to underwriting style and more conservative income/expense numbers are paired with a lower tax rate and growing income is offset with a higher tax expense.